Advocacy

Transportation is more than a way to move goods and people from one place to another. The integrated network of Wisconsin’s multimodal transportation system functions as a platform for the entire state economy.

Wisconsin’s competitiveness is directly affected by the strength of each mode of transportation and how efficiently they work together within the state’s transportation network.

Funding

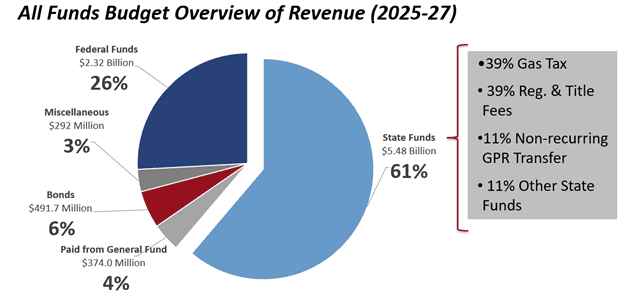

Wisconsin’s segregated transportation fund, which funds all transportation programs, is made up of federal funds, state funds, and bond proceeds.

State Funding – Wisconsin’s primary sources of transportation revenue are the motor fuel tax (commonly called the gas tax) and vehicle registration fees (including titling fees).

Historically, gas tax collections significantly exceeded revenues from registration and titling fees. However, the gas tax has not increased since 2006, while registration and titling fees have seen periodic adjustments, resulting in the two sources now contributing roughly equal amounts.

To compensate for these stagnant dedicated user fees, recent state budgets have increasingly relied on transfers of general purpose revenues (GPR) from the state’s general fund. Additionally, transit and debt service on some transportation general obligation bonds are funded directly from the General Fund.

In November 2014, Wisconsin voters overwhelmingly approved (80% to 20%) a constitutional amendment protecting the Transportation Fund. This measure prohibits the use of transportation-related user fees for non-transportation purposes.

Federal Funding – Federal transportation programs provide approximately one-quarter of Wisconsin’s total transportation revenue.

These funds are generated primarily through the federal gas tax, supplemented by growing transfers from the federal general fund to address shortfalls in the Highway Trust Fund.

States receive funding based on formulas established in multi-year authorization acts, along with annual appropriations and competitive discretionary grant programs.

The federal gas tax has remained unchanged at 18.4 cents per gallon since its last increase in 1993.

TDA Transportation Priorities

- A safe, modern, interconnected transportation network that will support a robust economy and enhance the quality of life for everyone in Wisconsin.

- Adequate user fees to pay for the maintenance and improvement of the state’s transportation network.

- Diversity of funding sources for Wisconsin transportation.

- A strong federal-state partnership for transportation funding.