LinkedIn – by Debby Jackson, Executive Director of the Transportation Development Association of Wisconsin

As part of the gig, the executive director of the Transportation Development Association gets the use of a car. I affectionately call it the TDA Mobile. I have to admit that the TDA Mobile doesn’t boast as many cool gadgets as a James Bond car. However, I am very fond of its adaptive cruise control. While it’s no crime-fighting machine, it does get me safely from one corner of our beautiful state to the next.

During my tenure at TDA, there have been several TDA vehicles. Each traded in when it reached five to seven years old.

Most of them have been a modern version of a family wagon, with plenty of space in the back for everything you might need for a multi-day conference. These vehicles are the equivalent of the comfortable brown loafer—tried and true—versus the flashy wingtip spectator Oxford.

Because of the focus on function, TDA stuck with multiple small SUVs from the same U.S. automaker, including three of a particular model.

Earlier this year, when I went to replace the last TDA Mobile, I felt like I was living out the Legislative Fiscal Bureau’s (LFB) Informational Paper #40 – Transportation Finance. I am a geek, but even I was disappointed that my life didn’t better resemble a campy ‘60s movie, classic TV, or an iconic comic book.

When talking about fuel economy, the LFB information paper #40 puts forward this example:

“To illustrate this point, according to IHS Markit (the state’s economic forecasting consultant), in 2006, the average fuel economy of the national light vehicle fleet was 20.3 miles per gallon. Their current projections indicate that the average fuel economy will increase to 25.4 miles per gallon (MPG) in 2025. As a result, an average motorist in the state who drives these vehicles for 12,000 miles per year will be purchasing an estimated 118.7 fewer gallons of fuel in 2025 than they were in 2006 due to the increased fuel economy of their vehicle. Therefore, such motorists will be paying an estimated $36.68 (118.7 gallons x 30.9 cents per gallon) less in state fuel taxes than they did in 2006 for the same amount of travel.”

The LFB goes on to equate the nearly $37 annual reduction in gas tax per average motorist to 7.8 cents per gallon and $267 million annually in lost motor vehicle fuel tax revenue.

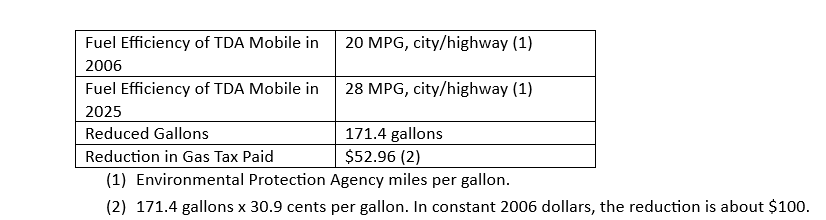

Now, let’s compare this LFB national average example to the new TDA Mobile, assuming 12,000 miles a year.

Remember, the latest TDA Mobile is a brown loafer with no ejector seat or flames from the exhaust and a standard gas-powered engine. The TDA example is the equivalent of a 12.35 cents per gallon reduction from 2006 ($52.96/428.6 gallons [12,000 miles/28 MPG]). The difference between the two examples is mainly due to the decades it takes to turn over the national fleet versus TDA’s one-car fleet. And of course, my actual MPG could vary from the EPA city/highway average depending on my type of travel and how heavy my foot is on the gas pedal.

Many may look at these examples and claim our 100-year-old gas tax is no longer up to the job. Yet, I look at it differently.

Currently, about 97% of Wisconsin’s fleet is neither hybrid nor electric. These are simply more efficient gas-powered vehicles, like the TDA Mobile. As long as that is the case, we can modernize the gas tax just as automakers have updated TDA’s old reliable ride over the last 20 years.

By not acknowledging the increased efficiency in standard gas-powered vehicles, we are giving people an unseen gas tax rebate, stressing our trusty user-pays model, and placing more demands on general fund revenues.

Someday, the majority of Wisconsin’s fleet will be electric, hybrid, or fueled by some source yet dreamed. And we should plan for that.

Until then, if we don’t like the condition of our roads, just realize we’re likely getting what we paid for.